The Chicago Region is a Leader in Food and Beverage Production

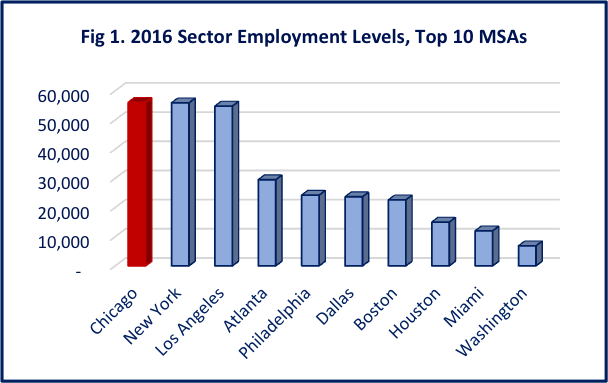

Chicago has a storied economic reputation for manufacturing, transportation, and distribution, but did you know that the Chicago Region is also a leader in the food and beverage industry? This blog post examines the employment and occupations trends in the food and beverage manufacturing industry [1] in the Chicago Region,[2] and compares them with the top 10 U.S. Metropolitan Statistical Areas (MSAs).[3] The most current employment estimates released by the U.S. Department of Labor’s Bureau of Labor Statistics (BLS) indicate that the Chicago Region ranks first in food and beverage manufacturing [4] in terms of employment in 2016 (Fig 1).[5] A historical analysis of employment levels shows that the region has been in the top position along with the Los Angeles Region for the last ten years. With 1,379 business establishments, the industry currently employs over 56,000 people, making it the second largest manufacturing sector in terms of employment (after fabricated metal manufacturing).

If these trends continue, this sector will likely become the largest manufacturing sector in the Chicago Region. Enforcing this trend is the fact that, unlike other manufacturing sectors in the region, employment is not declining. The positive regional and national employment trends in food and beverage manufacturing are largely driven by population growth and increased food consumption. Also, a unique distinction of the food and beverage industry is that in contrast to other manufacturing sectors, food processing jobs are not readily moved offshore.

Leader in Food Heading link

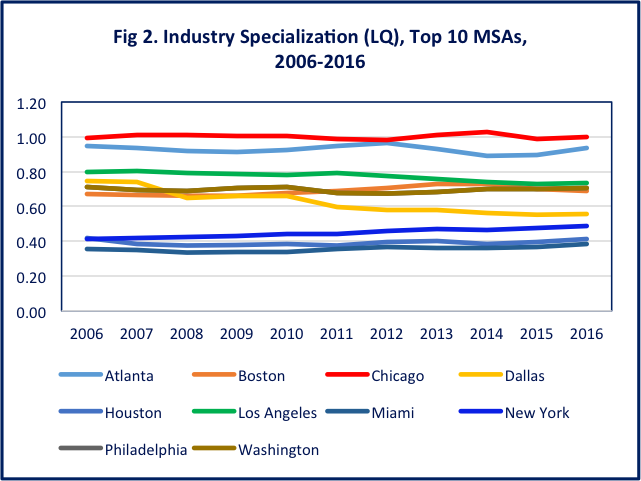

Besides its large employment figures, food and beverage manufacturing jobs are highly concentrated in the Chicago Region. None of the other MSAs examined appear to be specialized in this industry group (by location quotient, or LQ, measure). It is notable that the Chicago MSA consistently has the largest LQ among the regions analyzed (Fig 2). In other words, establishments in this sector enjoy external economies of scale. These effects are pronounced in creating: (1) a specialized labor pool, (2) specialized services and infrastructure, and (3) knowledge and innovation. As a reflection of its strong position in the country in terms of employment, the Chicago Region has a large concentration of people with relevant occupations in this industry. Of the top 20 food and beverage occupations, 11 in the Chicago region have a concentration of people above the national average. No other major MSA has such a high concentration. This data suggests that Chicago food and beverage manufacturing establishments carry out specialized activities that might not be possible in other regions across the country.

The Region Heading link

The region’s dominance in this sector could be explained by: (1) proximity to a large farming hinterland, (2) an efficient transportation and distribution network (as evidenced by Chicago’s strong freight and rail networks), and (3) the presence of older established companies. In order to maintain and improve its strong position in this sector, the Chicago region could further invest in the social infrastructure that has allowed the food and beverage sector to become a leader in the country. For instance, the April, 2017 launch of the Chicagoland Food & Beverage Network is a positive step to foster innovation, collaboration and growth among region’s companies. Initiatives such as the Chicagoland Food & Beverage Network will catalyze the diffusion of new technologies and knowledge about new markets among local firms. However, local firms should also be open to innovative ideas originating from outside the region to avoid regional lock-in.

In sum, this analysis demonstrates that the Chicago Region has a competitive advantage in this industry in comparison to other major regions in the U.S. The superior position that Chicago currently holds is an asset available to regional policy makers, industry leaders, and other stakeholders when analyzing the region’s economic strengths. Furthermore, the criteria that allow for Chicago to lead in this industry – its proximity to a large farming hinterland, an efficient transportation and distribution network, and the presence of older established companies – all serve as extant resources that are readily available in order to further enhance the food and beverage production in the region.

Footnotes Heading link

Footnotes:

[1] The industry includes NAICS 311 (Food Manufacturing) and NAICS 312 (Beverage and Tobacco Manufacturing).

[2] The Chicago Region refers to the Chicago-Naperville-Elgin MSA that consists of 14 counties.

[3] The top 10 MSAs are selected based on their current (2016) population size as reported by the US Census Bureau.

[4] This is a very broad sector. As the industry organization globalEdge notes “Any product meant for human consumption, aside from pharmaceuticals, passes through this industry”.

[5] A recent briefing by World Business Chicago highlights the size of industry in the Chicago Region by examining sales and number of establishments in the food and beverage industry. This blog complements that assessment by analyzing the geographical concentration of employment and occupations in the region and introducing a historical perspective.